Latest mutual fund update

Latest mutual fund update

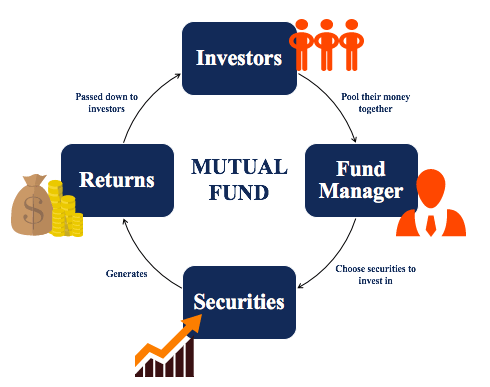

Mutual funds are one of the most tax-friendly investing choices available to Indian investors.

An important aspect to notice in mutual fund investments is that an event of tax arises only upon the selling of units of a latest mutual fund update scheme.

Latest mutual fund update:

In the Latest mutual fund update: ICICI Prudential Mutual Fund has introduced two target maturity funds.

The first of which is based on G-Secs, or the government of India bonds.

In the Latest mutual fund update, ICICI Prudential Mutual Fund has launched two target maturity funds, the first of which is based on G-Secs, or the government of India bonds.

The second is based on SDLs, which are state government bonds.

The ICICI Prudential Nifty G-Sec Dec 2030 Index Fund will be available in 2030, while the ICICI Prudential Nifty SDL Dec 2028 Index Fund will be available in 2028.

The Nifty G-Sec Dec 2030 Index Fund will be available from October 4 to October 10.

The Nifty SDL Dec 2028 Index Fund, a new fund offering, will be available from October 4 to October 11.

The two funds will invest in and hold the constituents of their respective underlying indices until maturity.

The maturity of the Nifty G-Sec Dec 2030 Index is 7.36%.

How does the strategy work?

It works in this way, if you decide to invest in the index and hold it till maturity, the index will return 7.36%. Your fund return will match the index return subject to tracking mistakes if there are any, and the expense ratio.

The Nifty SDL Dec 2028 Index has a yield to maturity of 7.64%.

One of the categories of debt funds with a set maturity is target maturity funds.

A current target maturity can invest solely in debt instruments with the best credit quality.

These include universal paper or G-Secs, SDLs, and credit-1,2 and 2 bond portfolios.

The target will be protected as a result of credit quality.

Additionally, you are shielded from interest rate risk if you hold onto your investment in them until maturity.

Target maturity funds typically enjoy cheaper taxes compared to fixed deposits, much like other debt funds do.

When you redeem your units from the target maturity fund after holding them for more than 3 years and after applying for indexation benefit, your taxed return at a flat rate of 20% plus 4% cess.

Speaking at the product launch, Chintan Haria, Head of Product Development and Strategy at ICICI Prudential AMC, said, “Investors seeking fixed duration returns within a particular maturity bucket can consider investing in target maturity index funds in a rising interest rate situation.

Investors who hold their investments for more than three years benefit from indexation, which dramatically boosts post-tax profits for individuals with higher tax rates. Thats the Latest mutual fund update.